Warren Says Hello

Posted by Warren Goodridge @Oct 15 2021

As we inch towards the close of 2021, it is difficult to reckon with the hardship we have all been through as individuals, a community, as a nation since March of 2020. The COVID-19 pandemic has taken from all of us in some way. Many of us have been affected either financially, emotionally, mentally, or physically; but, as resilience is a defining trait of humanity, we want to try to extract some positivity out of current events.

In listing the positives that have risen out of the pandemic, I would like to highlight the fact that more and more Americans have decided to start their own businesses. Self-employment is a type of economic empowerment due to the ability to set ones’ own hours, increased flexibility in managing time around the family and removing many of the inequities that occur in the workplace. Small business development has been increasingly at the forefront for many nonprofit groups as well as many city and state agendas.

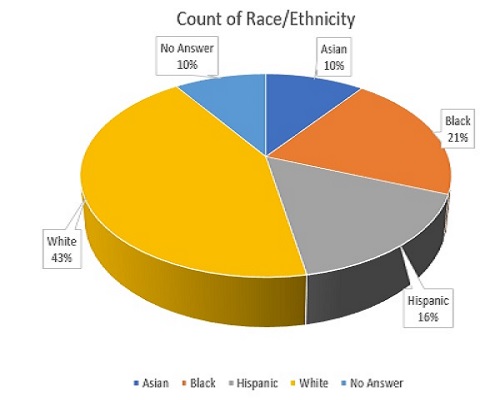

One example of these forces involves the inequities that occurred with PPP lending and continues to occur with lending to small businesses owned by people of color. Many of the neighborhoods in New York City that are comprised of people of color are unbanked. As a result, the amount of PPP lending and small business assistance in these communities were sorely missed. By contrast, Brooklyn Coop provided close to $6MM in PPP loans to these communities in 2021. Of this total 47% was lent to minorities and people of color and 45% of the businesses financed were majority women-owned businesses.

“We began our business relationship with Brooklyn COOP during one of the toughest times we have experienced as a business. They were there when we needed them. They were attentive, efficient and extremely professional. I heard stories from other business owners as to how difficult it was to get the PPP from other financial institutions. That was not our experience. We want to thank Brooklyn COOP for helping us through a difficult time and look forward to the possibility of working with them in the future.”

“We have greatly enjoyed working with Rebecca and Jesus at BK Coop.”

“You all are wonderful!”

“Laurel Leckert, Daniel Gonzalez, and Shardée Grey have all been wonderful!”.

The Business Mentor’s purpose is to provide busines-owners with the tools and resources to start and improve their business. Placing a Business Mentor within a financial institution solves a tremendous gap I had witnessed personally over my 14 years of experience in retail banking. Often in banking, a business that does not meet the criteria for lending is not provided tools that would improve their lending odds, or guidance regarding other options for capital support, like business grants.

In my previous positions within banking, I met many business owners across various stages of the business lifecycle arrive at a point where they did not understand their next steps. I found myself explaining to business owners why it was important to be MWBE certified, or why they might hold off on incorporating and start as a sole proprietor to see if their idea was viable, or why that thing your friend told you to do to avoid paying taxes was probably not the best idea. During many of these conversations, I would imagine how many businesses could be helped if their financial institution cared enough to dedicate resources towards helping small business-owners with all their general business questions. After all, this is where business owners spend an abundance of their time. Like, why isn’t this a thing? It was when I saw that the Brooklyn Coop created this role, a service that I believe in, that I decided to join the Brooklyn Coop team.