Remote Deposit Capture

Members must request this service individually through the BCoop mobile app. You will be informed whether you qualify and what daily deposit limit will apply.

Please read the Remote Deposit Capture Terms and Conditions when enrolling in RDC to understand your rights and responsibilities, and how to use RDC.

Brooklyn Coop does not charge a fee for RDC. You may incur data fees from your mobile service provider.

How to Enroll in RDC

(1)

Download the Brooklyn Coop mobile app. If you haven’t yet set up your online account you will need to do this before you are able to log into your account

(2)

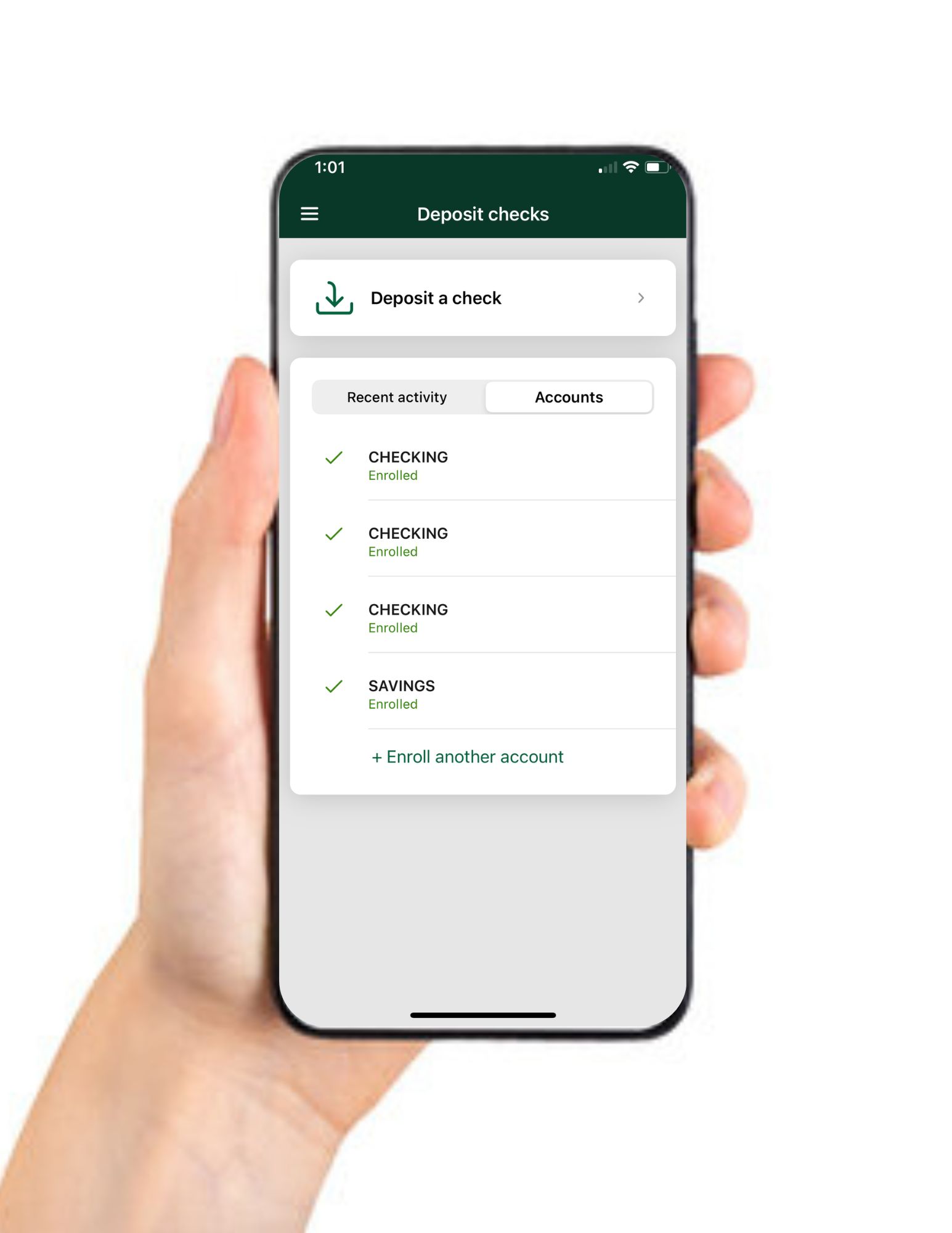

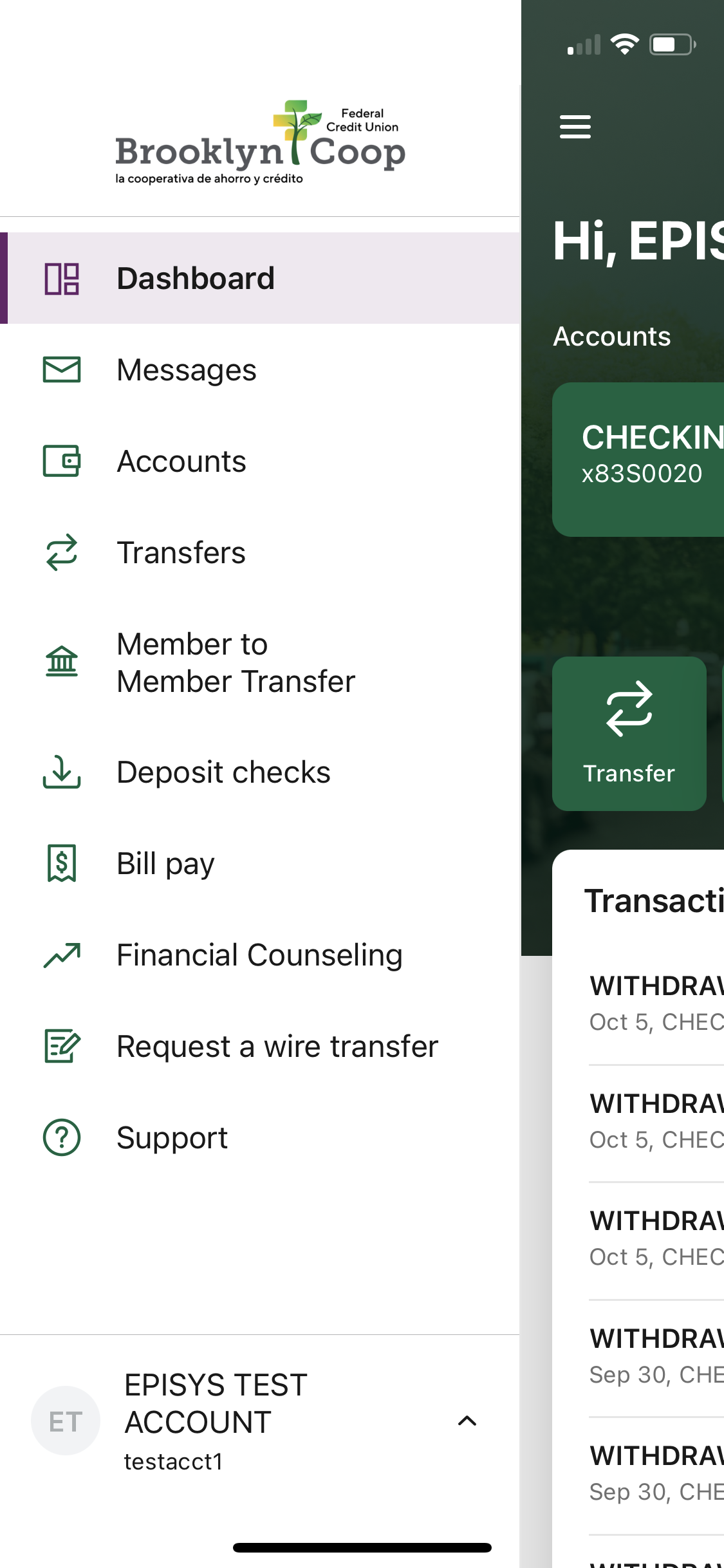

How to Register for Mobile Deposit: Once logged into the app, click on the “hamburger” (three horizontal lines) in the upper left corner, and choose the “Deposit Checks” option. The first time you click here you will be asked to enroll and be directed to a weblink to sign up for the Mobile Deposit feature. Follow the steps. We will respond to you within one business day to confirm that you have been approved. Once approved you will be able to log back into your mobile app and click again on the option “Deposit Checks” where you will be able to continue the process.

How to Deposit Your Checks

(1)

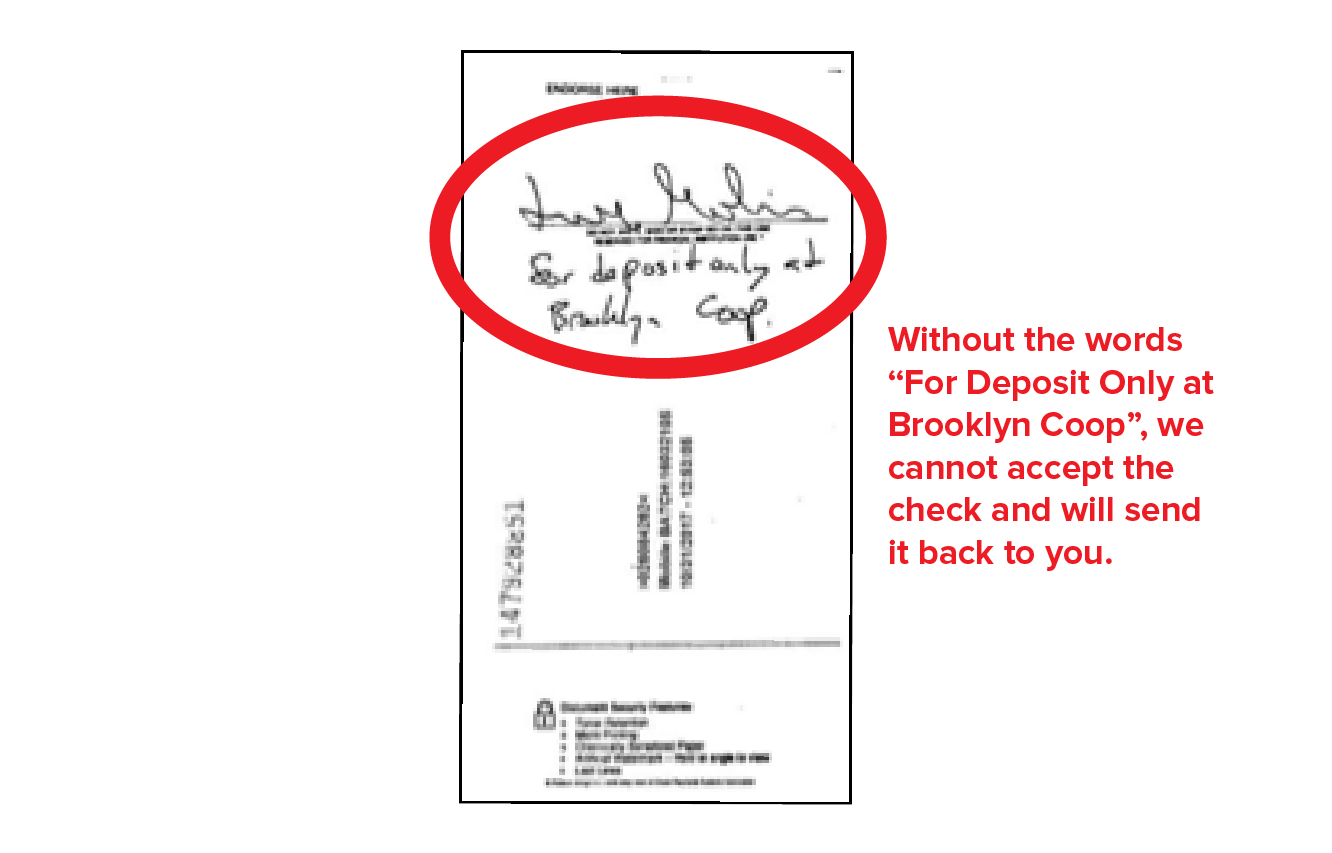

Endorse the back of your check with your signature, account number, and the words ‘FOR DEPOSIT ONLY AT BROOKLYN COOP.’

(2)

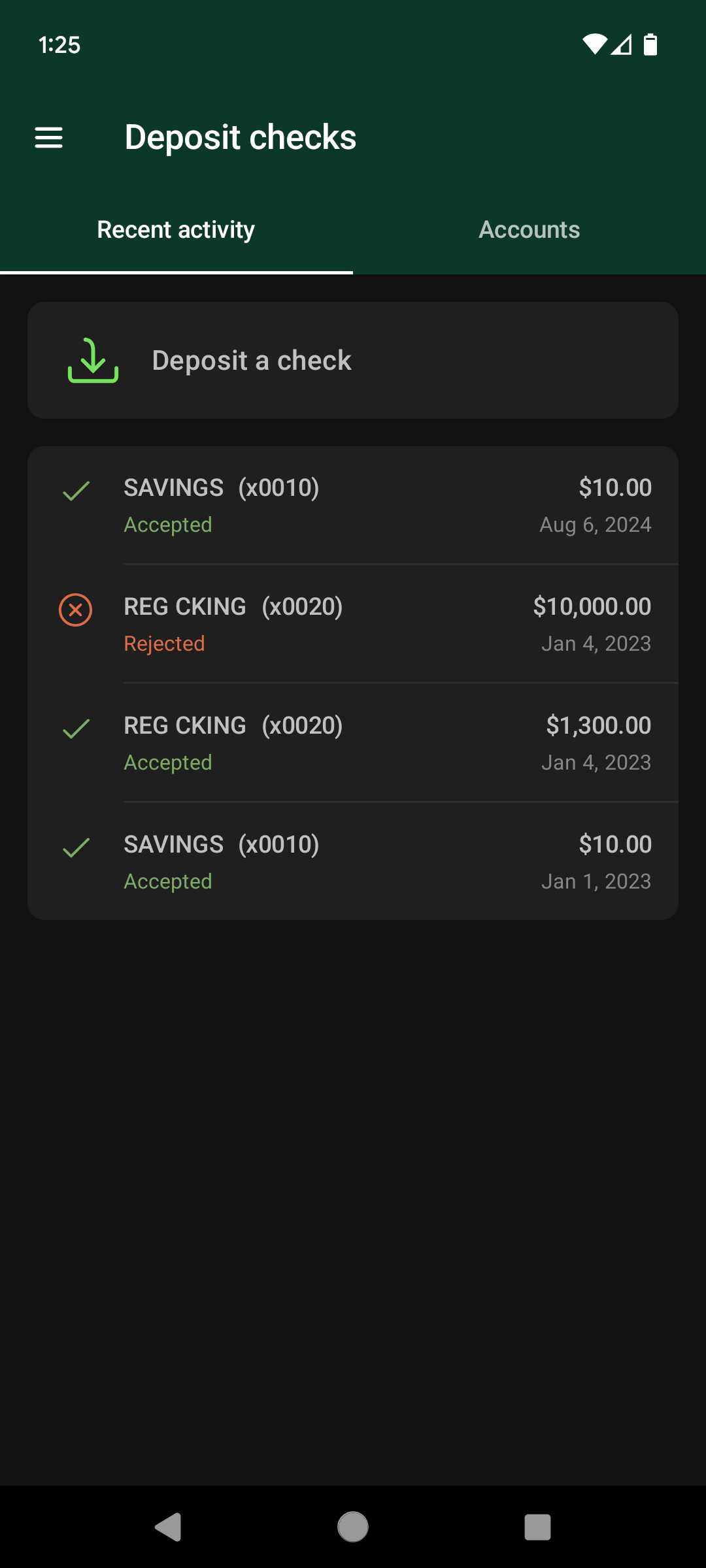

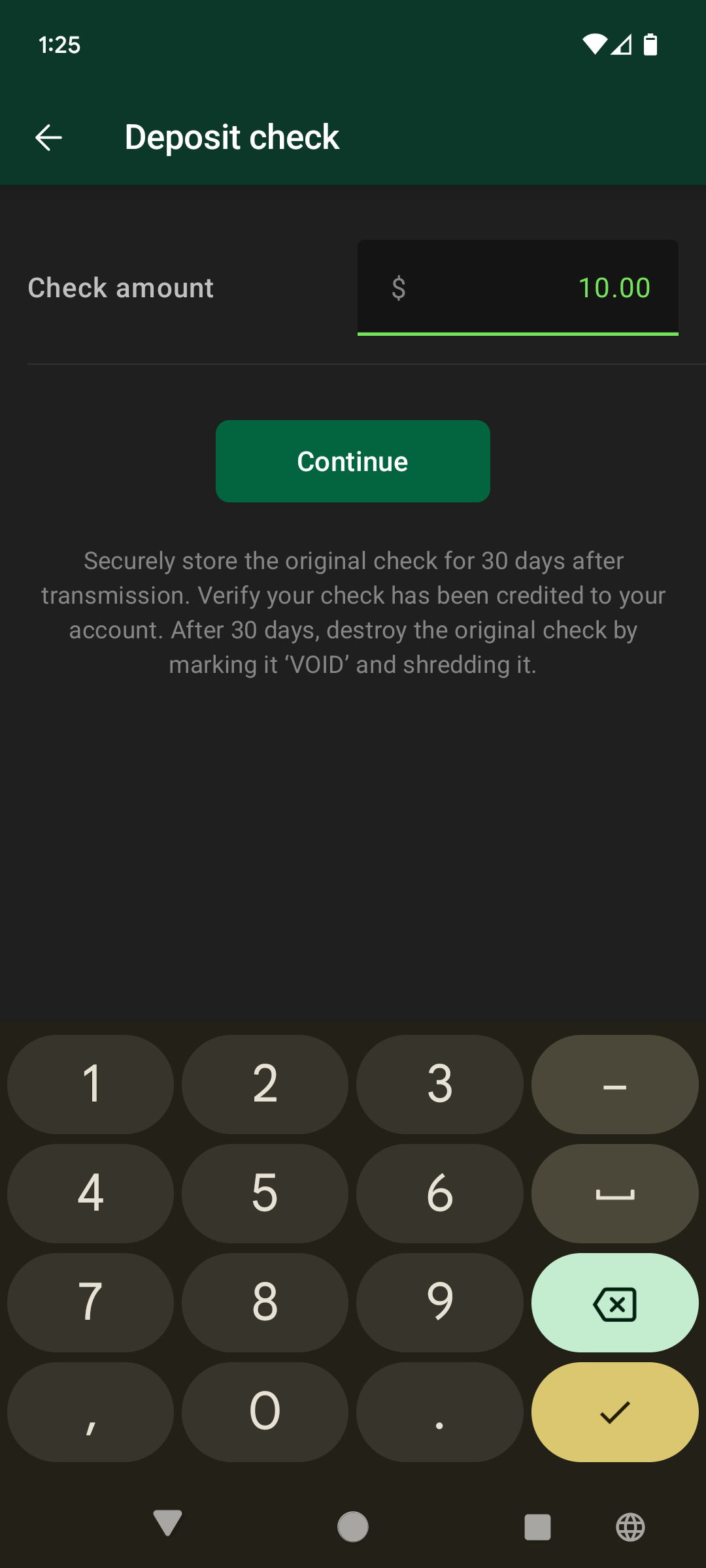

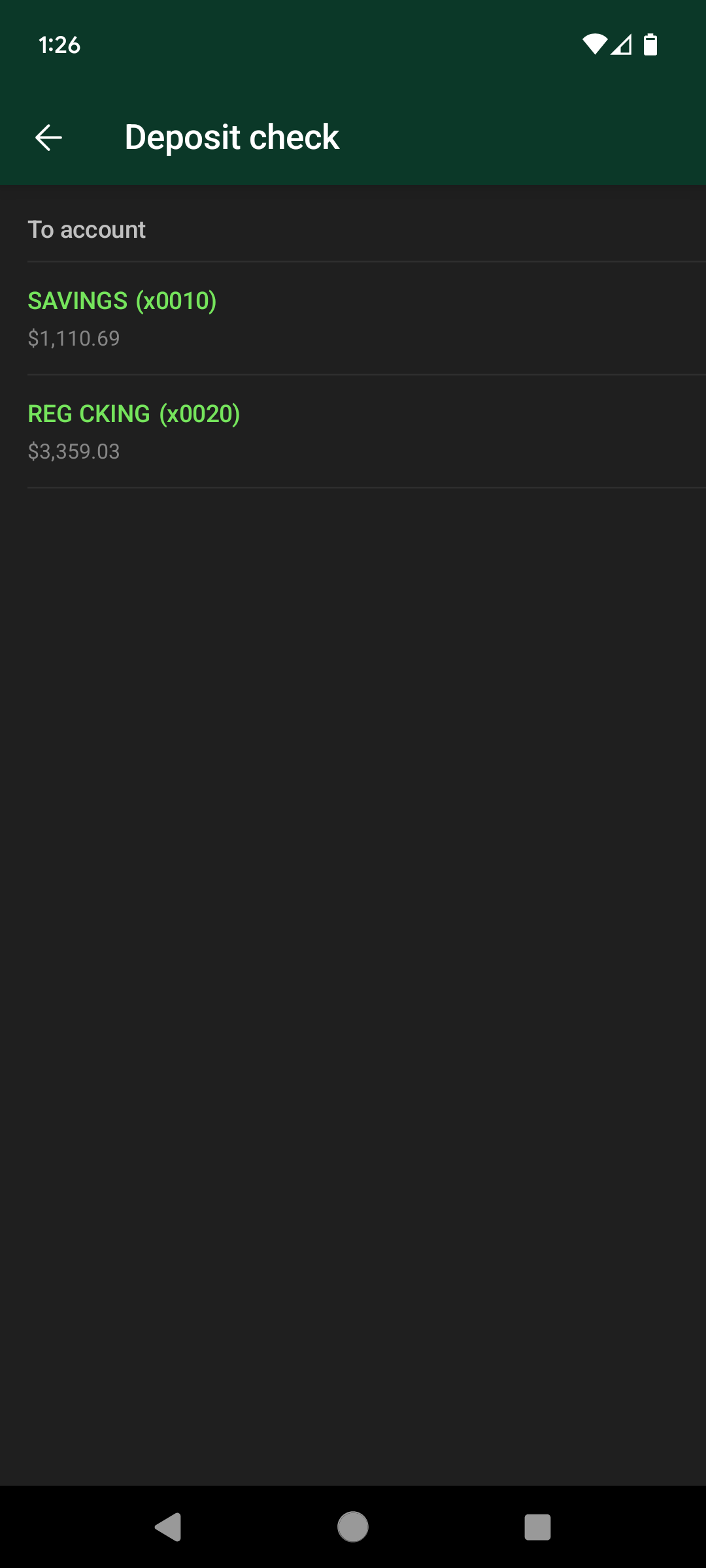

Open the mobile app and click on ‘Deposit Checks.” Follow prompts and instructions to capture the check details. (see screenshots for details)

(3)

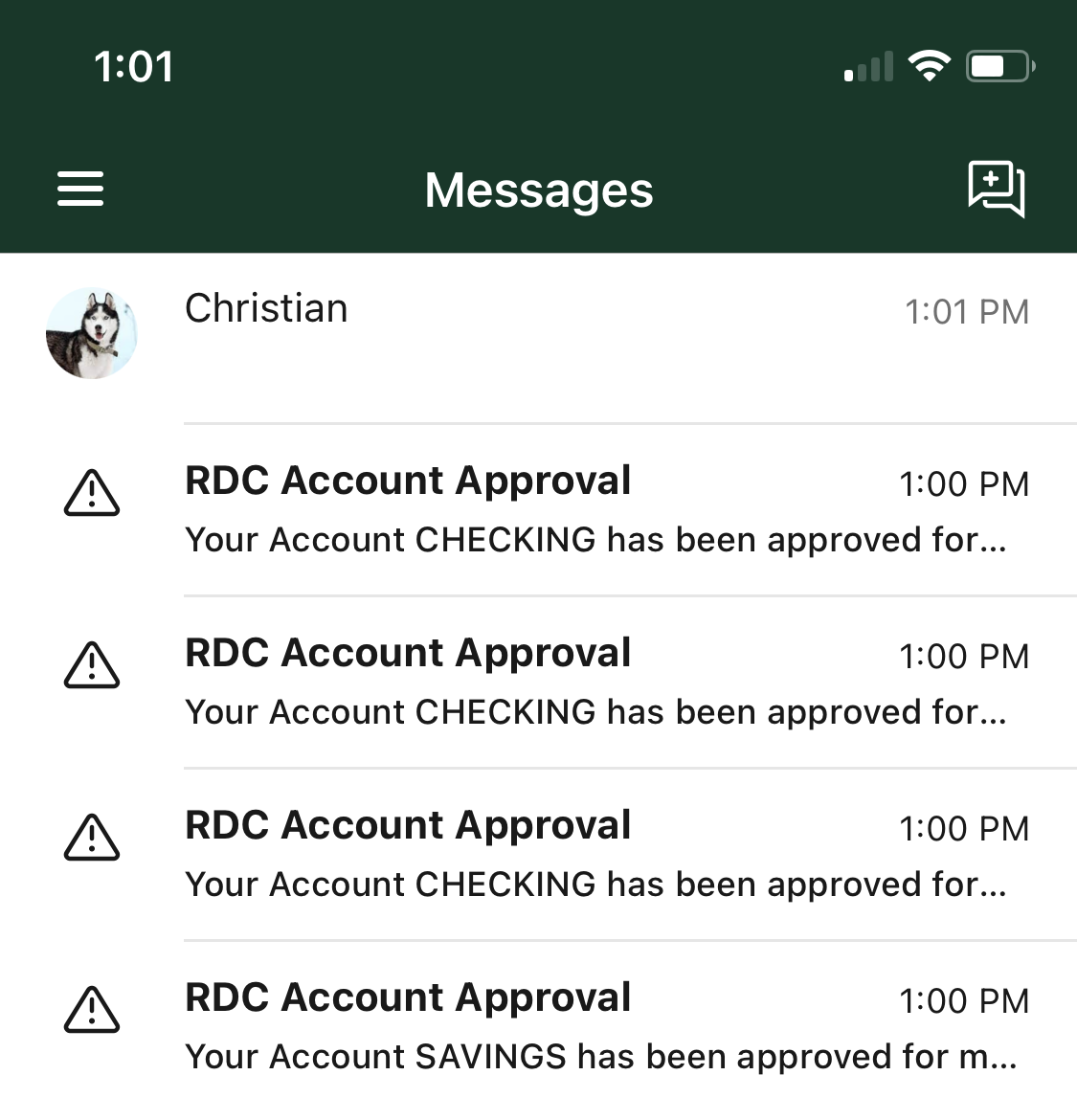

If the transmission works, you will receive a confirmation message. Please save and DO NOT DESTROY your check image right away. The confirmation message ONLY indicates that the check was successfully submitted. We manually review all remotely deposited checks, so if we are not able to accept the check through Mobile Deposit, you will need the original check to redeposit it through app or in person.

FAQ’s

Who can use RDC?

- Must not have any accounts in a charge-off status

- Must not have more than two overdrafts or bounced checks within the last year

How do I endorse my check?

Are there time restrictions for submitting checks to the bank?

What should I do with the original paper check after I make the deposit?

When will I be able to see the deposit in my account?

How will I know if my deposit has been accepted?

What type of checks can be deposited using RDC?

What type of checks cannot be deposited using RDC?

- Travelers Checks, and Savings Bonds

- Checks payable to any person or entity other than the account holder(s)

- Checks drawn on your account either with us or another institution

- Checks that are more than 6 months old, unless stated otherwise on the check

- Items that are stamped with a “non-negotiable” watermark

- Checks containing evidence of alteration to the information on the check

What do I do if RDC is not available to me?

Who should I contact if I have a problem with a deposit?

Contact us at (718) 418-8232 option 0 or email at rdc@brooklyn.coop