Navigating the Future of Payments: What Brooklyn Coop Members Can Expect in 2025

Post by Samira Rajan on Mar 11, 2025

What to Expect With Payments in 2025

A long time ago, way back at the start of this blog in 2017, I wrote a series of posts trying to explain the nuts and bolts of payments. Everyone understands cash and checks, but the differences among electronic transactions is confusing. Back then I focused on ACH, debit cards, and wire transfers. These days there are a ton more options, making it even more confusing. Still, my goal is to reduce the confusion so that members can be confident and knowledgeable about the choices that are available to you. That is why Daniel wrote the blog post last month on the pros and cons of crypto-currency as an investment strategy [1], and we brought in Emily Fascilla [2] to answer members’ questions about crypto at our Cash IRL conversation [3].

Back to payments: there are three changes in payments happening this year that may affect Brooklyn Coop members.

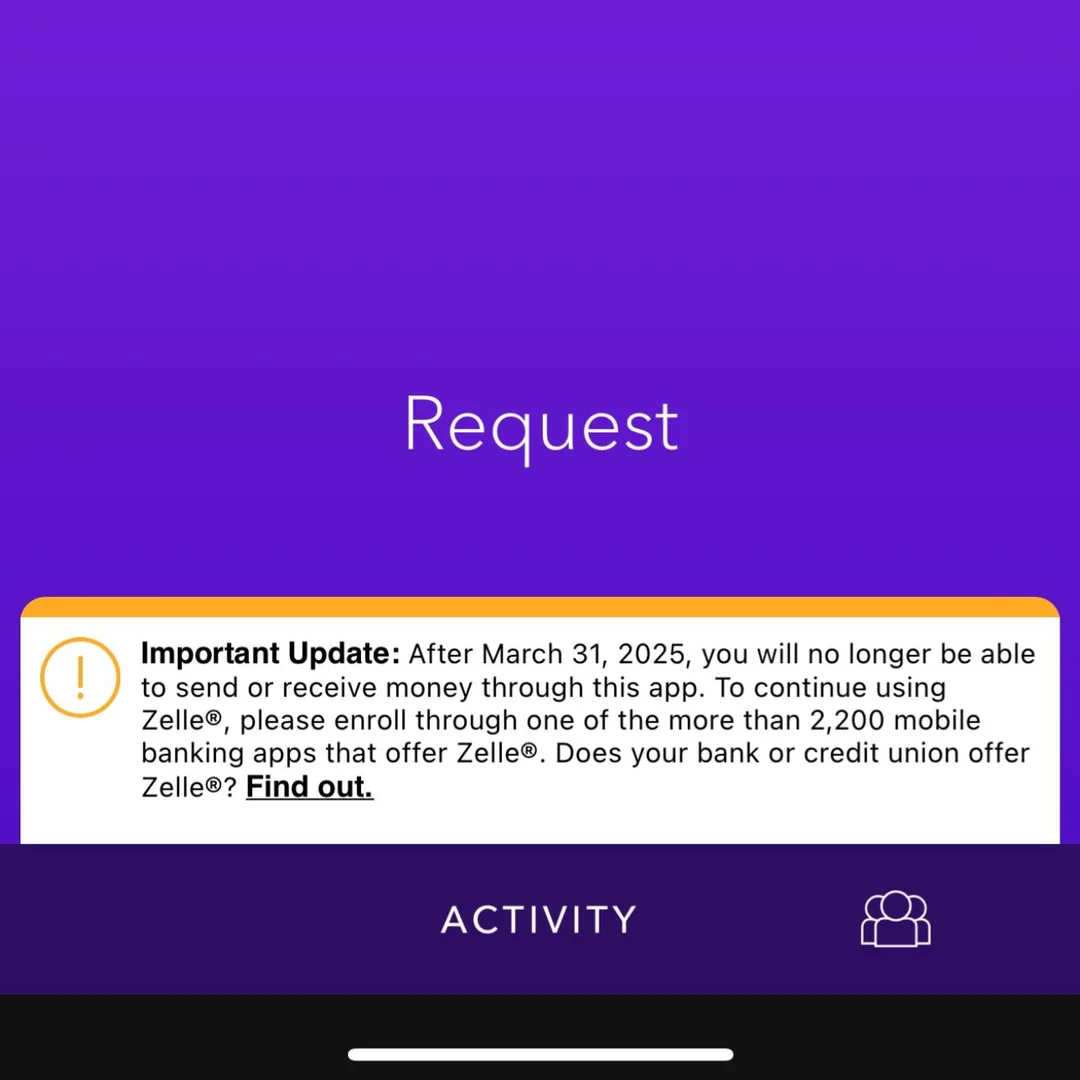

First, Zelle is eliminating its stand-alone app [4], which will remove our members’ ability to use Zelle. Brooklyn Coop itself was never a part of Zelle both due to cost and due to the insecurity of the platform [5]. However, some members were able to link their Bk Coop debit cards to Zelle in the stand-alone app. This functionality will end at the end of this month, which means more members will be looking to Brooklyn Coop for other ‘instant payments’ options.*

Second, Brooklyn Coop will implement an ‘instant payments’ feature within a few months. Our provider will be Neural P2P [6]. After much market research, we signed with Neural based on two critical features:

(1) it will live entirely within Banno, which is Brooklyn Coop’s mobile banking app, allowing for seamless and secure transfers from your Bk Coop accounts. Zelle was not part of our app and that is one of the reasons why Zelle transfers were not as secure.

(2) it allows the other party to your transaction more than one way to complete the transaction. They or their bank doesn’t have to necessarily be a member of Neural. This means that when you send funds via Neural the recipient can choose to receive those funds either in their bank account or their Paypal or on a prepaid card. Look for more news on the Neural P2P integration this summer.

The third change in payments this year is Brooklyn Coop’s adoption of FedNow [7]. At some point there may be some ability for individuals to use FedNow for instant payments, but the primary benefit of FedNow to our members is the immediate receipt of payments to businesses or deposits from the government. Members who receive payroll or social security or tax refunds into their account via direct deposit, or who pay bills from their account using ACH, know that there is a 2-3 day delay between when the funds leave one financial institution and arrive in the other. FedNow promises to complete these payments instantly.

I’ll update you all on these services as we implement them. As always, feel free to reach out with any of your questions.